The MLS Search & Analysis Show | 1-50

How to Earn 25% ROI with Rental Properties | MLS Search & Analysis 50 - 3348 W 82 & 3764 Washington

You don't want to miss this rental property analysis. In the 50th episode of The MLS Search & Analysis Show James Wise is looking for multi family properties for his client Spicy Chilly from California. Spicy Chilly has $50,000 in cash that she would like to use as a down payment to purchase a multi family property in the Cleveland, Ohio market that delivers her an average cash on cash return of at least 10% annually. James breaks down the numbers on two duplexes in the Cleveland market for her that have the potential to earn an average cash on cash return of up to 25%. One duplex is located on the west side of Cleveland and the other duplex is located in a near east side suburb called Newburgh, Heights. During the show James breaks down the property conditions, estimated income and expenses as well as the risks, neighborhood profiles, point of sale pros/cons and much more.

$1 Billion in Cleveland? Do a 1031 Exchange! | MLS Search & Analysis 49 - 3355 W 43 & 3121 W 101

In the 49th episode of The MLS Search & Analysis Show James Wise's Silicon Valley client Karim is back looking to spend his last $125,000 of a 1031 exchange within the next 8 days. Karim has opened up his search criteria and is looking to maximize the amount of rental income he can achieve with these funds so James identified a quad along with a side by side duplex in D and C class neighborhoods on the west side of Cleveland, Ohio. During the show James goes in detail on the neighborhoods, the buildings, estimated expenses, buying the ugliest homes in a neighborhood, low income investment risk factors, tenant base (including some tenants he thinks are savages) and a 1 billion dollar investment commitment from MetroHealth which leads James to believe there could be some serious gentrification affecting one of the neighborhoods discussed in the show.

Financial Freedom Through Real Estate in Ohio | MLS Search & Analysis 48 - 10014 Almira & 4508 Alpha

In the 48th episode of The MLS Search & Analysis Show James Wise searches the market for rental properties for his client Oliver from Hawaii. Oliver has $50,000 in cash that he and his wife want to stretch into as many mortgages as possible so that they can create enough passive income to allow her to retire from her job and stay at home with the children they plan to have. James breaks down the numbers on two multi family properties that allow Oliver and his wife to turn that $50,000 into four rental income checks every month and still have some money left over for value add improvements or a portion of the down payment for the next addition to their rental property portfolio.

This Maryland Investor is Making Money in Ohio Housing | MLS Search & Analysis 47 - 1671 Glenmont

Understanding the potential ROI is one of the most important things an out of state investor needs to know how to do. In the 47th episode of The MLS Search & Analysis Show James is looking for a low risk multi family property for his client Roger from Maryland. Roger has been approved for a mortgage of up to $200,000 and would like to purchase a cash flowing investment property that is low risk, low maintenance and earns him a return of 10% or more on his money.

Long Distance BRRRR Investing Alternatives in Ohio | MLS Search & Analysis 46 - 12332 Southern

Is investing in an out of state BRRRR deal right for you? Did you know that there are alternative real estate strategies that allow you to stretch your cash almost as far with a lower level of risk? In the 46th episode of The MLS Search & Analysis Show James Wise's client Duane from Daly City, California is looking to start his real estate portfolio. Duane has invested in equities for years and has now decided to jump into real estate investing with $70,000 in cash that he would like to stretch that as far as possible while maintaining a traditionally financed portfolio that still cash flows while avoiding high risk Section 8 dominated neighborhoods.

Best Place to Buy Rental Properties: Ohio | MLS Search & Analysis 45 - 1292 Hathaway & 3124 Edgehill

In the 45th episode of The MLS Search & Analysis Show James Wise is looking for high quality rental real estate for his client Tim from Palm Beach, Florida. Tim has invested in real estate for years and he is now venturing into the Cleveland, Ohio market. Tim has $100,000 cash budgeted for the first stage of Cleveland, Ohio investing. With a very prestigious and high paying day job Tim plans on making several acquisitions every year and has a fairly unlimited budget to continue building his portfolio so long as the investments perform well.

Investing $150,000 in Cash Flow Real Estate Markets | MLS Search & Analysis 44 - 2224 Forestdale

Many real estate investors wonder which real estate market has the best cash flow. Cleveland, Ohio is one of the most popular cash flow markets in the USA. In the 44th episode of The MLS Search & Analysis Show James is searching the MLS for his client Dan from Ohio. Dan is an avid investor in the stock market but this is his first time investing in real estate. Dan has a budget of $150,000. $55,000 of that is in cash and he is looking to utilize residential financing to leverage himself into a larger real estate portfolio that maintains a cash on cash return of at least 9% while paying off all of the mortgage debt and cash flowing at least $400 per month.

How to Analyze a Cleveland Ohio Rental Property Online | MLS Search & Analysis 43 - 3426 E 121

You do not have to live close to a rental property to analyze it. You can analyze a rental property online using several clues to assess it's level of risk and profitability. The 43rd episode of The MLS Search & Analysis Show features a $19,900 duplex sent to James Wise by his client Ryan from Santa Clarita, California. Ryan is a first time Real Estate Investor who would like to start his Real Estate portfolio by investing in the Cleveland, Ohio market because the prices are so much cheaper than they are in the Santa Clarita, California area. Ryan is pre approved by a lender for $75,000 and would like to eventually hold a portfolio of A, B and C rental properties but doesn't think he can afford to get into that type of asset class at this time. James breaks down the $19,900 duplex Ryan sent in and explains why it's #JamesWiseDenied. James goes on to show Real Estate Investors a few ways that they can look for clues online to see if a property is in a highly distressed area and points Ryan in another direction that he feels will be a more appropriate buying strategy for Ryan's portfolio.

Analyzing a Home Run Deal in Real Estate | MLS Search & Analysis 42 - 10518 Parkhurst

In the 42nd episode of The MLS Search & Analysis Show Ben from Charlotte, North Carolina has hit a home run with the Cleveland, Ohio duplex he has sent in for James Wise to analyze. James breaks down the gross income estimate as well as the estimated fixed and variable operating costs such as maintenance, repairs, vacancy, non payment of rent, utilities, property taxes, insurance, cap ex, landscaping, property management and more.

Real Estate Investing While Stationed Overseas | MLS Search & Analysis 41 - 9901 Greenview

In the 41st episode of The MLS Search & Analysis Show James Wise is searching the Cleveland, Ohio area for a rental property for his client Jose, a Military IT contractor working in Kuwait. Jose has $30,000 to spend and would like to stretch his cash as far as possible using a traditional bank loan. Jose has a moderate risk tolerance and would like to avoid Section 8 rental properties. With this in mind James finds a duplex in Garfield Heights, Ohio for $89,000 that is in pretty good condition. James goes on to break down the financing and gross income estimates as well as the estimated fixed and variable operating costs such as maintenance, repairs, vacancy, non payment of rent, utilities, property taxes, insurance, cap ex, landscaping, property management and more.

Investing $250,000 on Long Distance Rental Property | MLS Search & Analysis 40 - 13318 Merl

In the 40th episode of the MLS Search & Analysis Show James Wise has a $250,000 budget to find his client, a Silicon Valley investor named Karim, a cash flowing multi family property in a B-Class neighborhood in the Cleveland, Ohio market that is already in turnkey condition. During the show James discusses Karim's current portfolio and why this property is different. He also breaks down the estimated cash on cash return, cap rate, monthly maintenance budget, renovation costs, expected tenant base and many other things Karim can expect to encounter if he purchases this property. In addition to all of that James introduces a new product he has to give investors the same MLS access that he has.

Which Cleveland Duplex is a Better Investment? | MLS Search & Analysis 39 - 6609 Bridge & 636 E 222

Out of state duplex real estate investing. Which duplex is the better investment property? In the 39th episode of The MLS Search & Analysis Show John from California is back getting another analysis from James Wise. John has found himself two properties to look over. The first one is a high end duplex in an A grade Cleveland, Ohio neighborhood. This duplex looks like it will fit in very well with the rest of his portfolio so he'd like James to look over the numbers and provide some additional due diligence. The second property is a duplex in Euclid, Ohio. Euclid is a very popular cash flow producing neighborhood but it has some big differences to what John from California is used to buying. On top of that James has some thoughts on the construction of the building that have him a bit undecided as to what John should do with the Euclid duplex. Watch the show to see if these properties are #JamesWiseApproved or #JamesWiseDenied.

Cash Flow Real Estate Investing in Cleveland Ohio | MLS Search & Analysis 38 - 3100 Daisy

Where are the best rental markets for cash flow located? One of them is in Cleveland, Ohio. In the 38th episode of The MLS Search & Analysis Show James Wise searches the MLS looking for cash flowing investment property for his client Doug from North Carolina. Doug is a seasoned real estate investor who has been doing real estate investing for over 15 years and has recently retired from his job as a Bank I.T. Manager to become a full time real estate investor. In the show James goes over a detailed breakdown of the numbers including the Cap Rate, Cash on Cash Return, Capital Expenditure Budget, Vacancy & Repair Budget, Insurance Estimate, Property Management Fees, Property Taxes, Lawn Care, Risk Assessment, Section 8 Strategy and much more.

Cleveland's $40k Investment Property Market | MLS Search & Analysis 37 - 21051 S Lake & 2056 W 101

You should always run the numbers before you buy an investment property. This rule is even more important if the rental property is out of state. In the 37th episode of The MLS Search & Analysis Show James Wise is back analyzing another two multi family rental properties for his out of state investor Mike, a New Mexico transplant now living in California. Mike has $40,000 to use towards building his rental portfolio in the Cleveland, Ohio market. In the show James goes over a detailed breakdown of the numbers including the Cap Rate, Cash on Cash Return, Capital Expenditure Budget, Vacancy & Repair Budget, Insurance Estimate, Property Management Fees, Property Taxes, Lawn Care and much more as well as the reasons why he believes that this triplex and duplex could make great acquisitions for Mike's rental portfolio if the quad James found for him in an earlier episode doesn't pan out for Mike.

Bad Real Estate Deal vs Good Real Estate Deal | MLS Search & Analysis 36 - 3224 Monroe/8415 Detroit

Bad real estate deals vs good real estate deals. Do you know the difference? In the 36th episode of The MLS Search & Analysis Show James Wise compares two quads for his client Mike, a New Mexico transplant now living in California. Mike has $40,000 to use towards building his rental portfolio in the Cleveland, Ohio market. In the show James goes over the reasons why he believes one of the quads will be a profitable investment and points out some red flags that lead him to believe that the other quad will be a money pit.

Should you Buy Rentals in Blighted Neighborhoods? | MLS Search & Analysis 35 - 3852 E 188

Does it make sense to invest in C class neighborhoods? Does it make sense to invest in D class neighborhoods? Does it make sense to invest in F class neighborhoods? Blight is all around. Are these rough rental properties the right investment for you? In the 35th episode of The MLS Search & Analysis Show Real Estate Investor James Wise provides an in depth analysis on a single family house in Cleveland, Ohio for his client Adam from Murrieta, California. Adam has a 10 year goal of growing his real estate portfolio to a point where it cash flows $10,000 per month. Watch the show to find out if this property is a good starting point for Adam or if the property is located in a neighborhood filled with blight.

Big Money Buying Ohio Houses | MLS Search & Analysis 34 - 5975 Ridge 4617 Brooklyn & 6950 Brandywine

If you are an out of state investor who is having trouble analyzing real estate deals than you'll want to check out this show. Holton-Wise can help you build an out of state rental portfolio. In the 34th episode of The MLS Search & Analysis Show James Wise searches the Cleveland, Ohio MLS looking for three multi family rental properties for his client Jeff from Alameda, California who has $110,000 from a 1031 exchange to use to start his out of state investment portfolio.

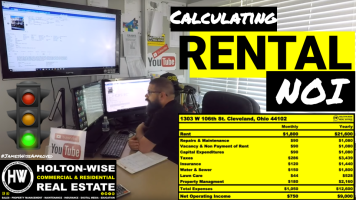

How to Run Numbers on Cleveland Investment Property | MLS Search & Analysis 33 - 1303 W 106

If you've ever wondered how to run the numbers on an investment property this video is for you. In the 33rd episode of The MLS Search & Analysis Show James Wise provides an in depth analysis on a high end duplex in Cleveland, Ohio for his Californian client John. In the video James breaks down the listing price and whether or not it's a good listing price compared to neighborhood comparables as well as many other factors that determine whether or not this rental property is a good investment. Factors discussed include renovation needs, ability to increase rents, financing, why he thinks that the layout is better than other duplexes along with monthly and yearly estimates on the gross income, net operating income and operating expenses such as insurance, taxes, property management fees, vacancy, repairs, cap ex and lawn care.

Increase Rental Income with this Duplex Investment Strategy | MLS Search & Analysis 32 - 261 E 250

Learn how to increase your rental income with this duplex investment strategy. In the 32nd episode of the MLS Search & Analysis Show James Wise searches the Cleveland, Ohio MLS looking for a multi family property that will work for his client Chris. Chris is a real estate investor living in the Phoenix, Arizona area who is looking for a stable investment that doesn't need a lot of work, can be purchased with a traditional residential mortgage and still has the ability to generate $3,000-$4,000 a year in cash flow after all of it's expenses are paid. Let's dive in!

Cleveland Ohio Apartment Building Scam | MLS Search & Analysis 31 - 12911 Brackland

In the 31st episode of The MLS Search & Analysis Show James Wise breaks down the risk level of a 7 unit apartment building for his client Dave from California. In the video James discusses the building's questionable history over the last 30 years, the level of blight in this particular Cleveland, Ohio neighborhood, the difficulty in estimating the building's CAP Rate and why he believes the apartment building is actually a 6 unit and not a true 7 unit.

Estimating Repairs on a Cleveland Ohio area House Flip | MLS Search & Analysis 30 - 5302 Tuxedo

This property is priced well below it's ARV. Does this deal work as a BRRRR? Does this deal work as a wholesale? Does this deal work as a flip? In the 30th episode of The MLS Search & Analysis Show James breaks down the numbers, neighborhood, scope of work, financing options and much more on a bank owned single family property in Parma, Ohio for his client April from Seattle, Washington. April has budgeted $35,000-$50,000 for her 1st investment in the Cleveland, Ohio market. She has found herself a bank owned single family house listed for $37,100 in a neighborhood where comps are well over $100,000. James breaks down the renovation cost to determine if it's a viable BRRRR deal, wholesale deal or real estate flip.

Analyzing Real Estate Deals: 8 Unit Investment in Ohio | MLS Search & Analysis 29 - 8208 Denison

Running the numbers on investment property is a very important skill that every successful real estate investor needs to master. In the 29th episode of The MLS Search & Analysis Show James Wise provides an analysis on an 8 unit apartment building in Cleveland, Ohio for his client David from France. The particular investment was presented to David by a French company that specializes in selling turnkey real estate to Foreign Nationals.

New Yorker is Looking for Cheap Multifamily in Ohio | MLS Search & Analysis 28 - 10609 Wadsworth

Cheap real estate is all over the Cleveland, Ohio real estate market. In the 28th episode of The MLS Search & Analysis Show James Wise searches the Cleveland MLS for his client Frank from Long Island, New York. Frank currently owns three rental properties near his home but is looking to expand into the Cleveland, Ohio market as the cash flow opportunity is greater in Cleveland than it is in Long Island. Frank has asked James to find him a duplex in a stable neighborhood that he can purchase with less than $25,000 out of pocket. Let's Dive In.

BRRRR on the Golf Course in Cleveland | MLS Search & Analysis 27 - 4416 Gamma & 5909 W Ridgewood

The BRRRR strategy is a very popular real estate acquisition tool for investors with a limited amount of money. If you are interested at seeing real life BRRRR deals with numbers included this video is for you. In the 27th episode of The MLS Search & Analysis Show James Wise searches the Cleveland, Ohio MLS for his clients Sean and Heekyung from Tacoma, Washington. Sean and Heekyung are looking to invest some money that they have refinanced out of a four plex in the Tacoma, Washington area into some cash flowing rental properties in the Cleveland, Ohio market. They are interested in BRRRR deals as well as any other properties that can deliver a passive income stream.

What's Wrong with this Cleveland Ohio Rental Property? | MLS Search & Analysis 26 - 12511 Plover

In the 26th episode of The MLS Search & Analysis Show James Wise analyzes a Lakewood duplex for his client John from California. This is an interesting investment property because it appears to be priced right & located in a highly popular area in the Cleveland real estate market. However it's been sitting on the market for an extended period of time. James dives into the data to do some due diligence on this rental property and figure out why the listing has gone stale.

Ohio Housing: Increase Budget vs Lower Standards | MLS Search & Analysis 25 - 14240 Cranwood Park

In episode 25 of the MLS Search & Analysis show James Wise is searching the Cleveland MLS looking for an investment property for his client Alonzo from Atlanta, Georgia. Alonzo is looking to start building his investment portfolio so he can eventually leave the hospitality industry and get out of the rat race once and for all. While going over Alonzo's specific investment criteria James notices that it isn't achievable in this market so James makes some slight modifications and points Alonzo to an investment strategy that is even better than Alonzo's original plan of attack.

Real Life BRRRR Strategy Fail (Cleveland Heights Ohio) | MLS Search & Analysis 24 - 2304 Noble

Not all BRRRR deals work out. Sometimes the property you want to use the BRRRR method on is a BRRRR strategy fail. In the 24th episode of the MLS Search & Analysis show James Wise breaks down the numbers on a Cleveland Heights, Ohio BRRRR deal for his client Rock, a CEO from Sacramento, California. In the show James explains why the opportunity cost is too high due to the extreme cost and inconvenience of the city's point of sale violation report. As this BRRRR is underwater it's a bad real estate investment.

Helping Investors Walk Away From Bad Cleveland Deals | MLS Search & Analysis 23 - 10603 Crestwood

Being out of state and buying high risk properties in the ghetto is how you will lose money in real estate. In the 23rd episode of the MLS Search & Analysis show James Wise cautions two new investors from going any further into this four plex. While quads are James' favorite investment property he thinks that this particular rental property is far too risky for his clients as they as the risk level associated with an asset like this one is incredibly high.

Looking at Cleveland Rental Properties | MLS Search & Analysis 22 - 3425 Altamont & 8280 Crudele

The Cleveland real estate market is very attractive to out of state investors due to it's low acquisition cost and high price to rent ratio. In the 22nd episode of the MLS Search & Analysis show James Wise searches the MLS for Arnold, an Investor based out of Salt Lake City, Utah who wanted to invest some funds in the Cleveland, Ohio market as he spent some time living in Akron, Ohio as a child. Arnold provided James with the goal of finding him a property that could bring in $300-$500 per month in NET cash-flow along with an average cash on cash return of at least 9%.

Parma Duplex Investment Strategy: Property Management Tips | MLS Search & Analysis 21 - 5595 Pearl

In the 21st episode of The MLS Search & Analysis Show Holton-Wise CEO James Wise checks in with his client Ken the airline pilot. Ken requested an analysis on a duplex in his rental portfolio in order to see what strategy would be best to maximize the return on his investment going forward. James goes over some strategy questions that Ken had about his investment including which renovations should be done in the vacant apartment, when renovations should be preformed in the occupied apartment, if it's feasible to add a 3rd rental apartment in the basement & whether or not it's possible to monetize the garage.

Investor Friendly Realtor Analyzing Out of State Deals: Ohio | MLS Search & Analysis 20 - 1335 W 61

In the 20th episode of The MLS Search & Analysis Show Holton-Wise CEO James Wise is back doing another analysis for John from California. This time James is running the numbers on a fully renovated luxury triplex in the Gordon Square neighborhood of Cleveland, Ohio. James breaks down why he loves this A-Class neighborhood, the types of tenants that can be expected, what he likes about the renovations that the seller's did to this property, if anything can be done to increase the rents, why two forms of egress is such an important thing to add to your rental renovations, financing options and much much more.

Calculating Rental Property Numbers (Cleveland Housing) | MLS Search & Analysis 19 - 4821 Bridge

Would you trade additional cash flow for a higher quality investment? In the 19th episode of The MLS Search & Analysis Show Holton-Wise CEO James Wise analyses a set of four Cleveland townhouses for an accredited investor from California. James breaks down why he loves this A-Class neighborhood, the types of tenants that can be expected, what renovations should be done to maximize the profitability of the building, financing options and much much more.

Unlimited Cash Return with Ohio BRRRR Deal | MLS Search & Analysis 18 - 2304 Noble & 10601 Linnet

If done property the BRRRR Strategy can provide a real estate investor with an unlimited cash on cash return. In the 18th episode of The MLS Search & Analysis Show James Wise is running the numbers on a couple properties in the Cleveland, Ohio market for Virginia based real estate investors Chris & Kelly. Chris & Kelly are looking to BRRRR their way into a portfolio of 10 more more multi family's in the next 5-7 years. James explains why the 1st property they were considering is #JamesWiseDenied & then finds them another two properties from the Cleveland MLS that are #JamesWiseApproved beyond that Jame breaks down the numbers including the CAP rate, expenses, net operating income & why one of the properties has the potential to produce an unlimited cash on cash return.

Stop Getting Ripped Off By Cleveland Wholesalers | MLS Search & Analysis 17 - 3676 E 151

Sometimes the best real estate deal is the one that you don't do. In the 17th episode of The MLS Search & Analysis Show James Wise analyzes a deal that a wholesaler presented to an investor who is based out of Australia. James Wise explains why he thinks this investment is overpriced in comparison to other investment opportunities in the Cleveland, Ohio market. James breaks down the risk factors of this investment, blight in the neighborhood it's located in as well as the MLS comps of properties in the immediate vicinity and similar opportunities in other areas of the Cleveland, Ohio market.

Stop Losing Money Flipping Cleveland Houses Out of State! | MLS Search & Analysis 16 - 1302 W 116

In the 16th episode of The MLS Search & Analysis Show Holton-Wise Co-Founder & CEO James Wise analyzes a potential flip property for one of his Australian clients who Invests in Cleveland Real Estate. This property was presented to James's client by a wholesaler who is claiming that the property can make over $87,000 if it's renovated & flipped. James breaks down the numbers, renovation budget, MLS comps & much more to determine how much (if any) money can be made on this deal.

Running the Numbers on Investment Property: Triplex | MLS Search & Analysis 15 - 3204 W 73

Here at Holton-Wise we sell more Rental Real Estate than anyone else in the Cleveland market. However we are not the only people who are selling Rental Real Estate in the Cleveland market. There are over 5,000 other Realtors in this market. On top of that there are wholesalers, FSBO's, Turnkey Companies, Bank Tapes & much more. In the 15th episode of The MLS Search & Analysis Show James Wise runs the numbers for an out of state investor who found a Triplex listed on the MLS by a Residential Realtor. James' provides an in depth analysis as to the earning potential of this property including the Cap Rate, Cash on Cash Return, ARV & much much more.

Calculating Cash Flow Numbers on a Cleveland Rental Property | MLS Search & Analysis 14 - 3358 W 48

Calculating numbers on a rental property in Cleveland, Ohio doesn't have to be hard. In the 14th episode of The MLS Search & Analysis Show James Wise from Holton-Wise analyzes a property in Cleveland, Ohio for one of his clients who is new to the market. James breaks down his thoughts on the neighborhood, the comps, the BRRRR strategy & every single number involved in the deal. Including the CAP RATE, Cash on Cash Return, Renovation Costs & much much more. If you are interested in investing in the Cleveland Ohio housing market reach out to HoltonWise today.

How To Analyze a Euclid Ohio BRRRR Deal by the Numbers | MLS Search & Analysis 13 - 727 Hemlock

Are you considering investing in Euclid, Ohio real estate? If not, you should as the Euclid housing market offers real estate investors like you a high return on your investment if you know what you are doing. If you have been looking for an intro to fixer upper rentals or BRRRR Real Estate Investing this is it. In the 13th episode of The MLS Search & Analysis Show professional Real Estate Broker, Investor & Property Manager James Wise from Holton-Wise analyzes a property in Euclid Ohio for some of his clients. In the video James breaks down the neighborhood, comps, the BRRRR strategy & how to reverse engineer needed repairs on a property with minimal information.

STOP! Don't Invest in Cleveland Until You Watch This | MLS Search & Analysis 12 - 7105 Lexington

Investing in a new real estate market can be scary. You NEVER want to invest in a new real estate market if you don't understand it. Cleveland, Ohio is a very popular real estate market for rental property investors because of the low prices. In episode 12 of The MLS Search & Analysis Show professional real estate broker, investor & property manager James Wise from Holton-Wise provides two of his out of state investors with an analysis on a potential investment property that was listed on the MLS by another real estate brokerage in the Cleveland, Ohio area. James breaks down the pros & cons as well as the surrounding neighborhood and tenant base. Everything an investor needs to know to make an educated investment decision in Cleveland, Ohio is here. DO NOT invest in Cleveland until you've watched this show.

DO NOT Buy Real Estate in Cleveland Until You Watch This | MLS Search & Analysis 11 - 1473 E 108

Do not invest in Cleveland, Ohio real estate until you watch this show. In episode 11 of The MLS Search & Analysis Show James Wise is analyzing a duplex for a couple out of state investors from Seattle, Washington. James Wise doesn't think that this property will work for them as they are hoping to do a BRRRR on the property. The problem is the numbers won't work as the property is overpriced as it's advertised as being in a high priced neighborhood. However it's actually in the ghetto in an area that is close to this nice neighborhood.

Is Cleveland Ohio a Good Real Estate Market? | MLS Search & Analysis 10 - 3126 Meadowbrook

Have you considered investing in Cleveland, Ohio real estate? If so you'll want to check out this video. In the 10th episode of The MLS Search & Analysis Show Real Estate Broker, Investor & Property Manager James Wise from Holton-Wise analyzes a duplex that was listed on the MLS by a Realtor from Howard Hanna for one of his Out of State Investor clients. He provides them with insight into both the property and the Cleveland, Ohio real estate market.

STOP Buying Cheap Houses in Cleveland to Rent | MLS Search & Analysis 9 - 11924 Parkview

In the 9th episode of The MLS Search & Analysis Show James Wise is looking at a property in one of Cleveland, Ohio's cheapest neighborhoods. During his analysis of the property James Wise recommends that his long distance investor pass on this property as it wouldn't be a good fit for their investment portfolio. James Wise goes on to point out who would be a good fit to buy this property. He also breaks down the neighborhood and what properties would make more sense for his out of state client and others like him.

Off Market Duplex in Parma, Ohio | MLS Search & Analysis 8 - 7029 Brandywine

If you've ever wanted to buy rental properties in Cleveland, Ohio you'll want to watch the 8th episode of The MLS Search & Analysis Show. In this episode one of the HoltonWise team members discuss the numbers on an off market duplex in one of Cleveland's most stable suburbs, Parma, Ohio. If you are interested in investing in Parma, Ohio or anywhere in Northeast Ohio, reach out to HoltonWise today.

Buying an Apartment Building in Cleveland Ohio | MLS Search & Analysis 7 - 3638 W 117

If you've ever wanted to buy rental properties in Cleveland, Ohio you'll want to watch the 7th episode of The MLS Search & Analysis Show. In this episode we send one of the HoltonWise team members out to a 22 unit apartment building in one of Cleveland, Ohio's most popular working class neighborhoods.

Cleveland Realtor looks at MLS for Rental Property Deals | MLS Search & Analysis 6 - 4009 Memphis

In the 6th episode of The MLS Search & Analysis Show professional real estate broker James Wise comes on HoltonWiseTV live to discuss a property he saw pop up on the MLS that would make a great investment for any out of state investor. Cleveland, Ohio is one of the most popular investment markets for rental properties. Investors from all over the US as well as foreign nationals come to Cleveland for the low barrier to entry and high cash on cash returns. Holton-Wise is able to assist them in top to bottom acquisition and management of their out of state rental portfolios.

Cash Flow in the Cleveland Ohio Real Estate Market | MLS Search & Analysis 5 - 3109 W 101

In the 5th episode of The MLS Search & Analysis Show James Wise is searching the Cleveland, Ohio area MLS for properties that produce the highest cash flow. The property James targets in this video is in a C Class neighborhood and has a price to rent ratio that beats most properties in other markets across the United States. Because of these types of properties the Cleveland real estate market is one of the most popular real estate markets for real estate investors across the US.

Driving for Dollars (Shaker Heights Ohio) | MLS Search & Analysis 4 - 3554 Lynnfield & 3537 Normandy

There is a lot of money to be made in the Cleveland housing market. In the 4th episode of The MLS Search & Analysis Show James Wise from Holton-Wise is driving for dollars in Shaker Heights, Ohio. Shaker Heights is a high end suburb of Cleveland, Ohio. During his drive James takes real estate investors on a tour of 3 duplexes that will all make great out of state rental property investments. He provides investors with a breakdown of the income & expenses as well as the estimated CAP rate & cash on cash returns these properties would likely achieve.

Get Started in Out of State Investing in Cleveland Ohio | MLS Search & Analysis 3 - 24243 Wildwood

Have you thought about investing in Cleveland, Ohio? Cleveland, Ohio is very popular with out of state investors looking for cash flow. In the 3rd episode of The MLS Search & Analysis Show James Wise is searching the Cleveland, Ohio area MLS for Rental properties that would be great for out of state investors. James Wise can assist investors from all over the world in buying ANY listed property in the Cleveland, Ohio area. Today he has a 1989 build duplex in ultra hot Euclid, Ohio. This thing is an investors dream. 100% occupied bringing in $1,700 per month. Priced at $145,000.

Finding Out of State Investors Rental Property in Ohio | MLS Search & Analysis 2 - 21670 Ball

In the 2nd episode of The MLS Search & Analysis Show James Wise from HoltonWise searches for Cleveland Rental property that is listed on the MLS. James Wise can assist investors from all over the world in buying ANY listed property in the Cleveland, Ohio area for investment purposes. Today he has found a near rent ready single family home in Euclid, Ohio that will rent out for $1,050 per month. This future cash flow positive rental property is only $54,900. Perfect for any out of state investor looking for passive cash flow in the Cleveland Ohio housing market.

Driving for Dollars in Cleveland Ohio | MLS Search & Analysis 1 - 2218 W 53 & 1672 Eddington

In the first episode of The MLS Search & Analysis Show, Cleveland Ohio Real Estate Broker & Investor James Wise is driving for dollars in Cleveland, Ohio. He is searching the Cleveland area for profitable rental properties that would work great for out of state investors and those looking for passive income. From there Holton-Wise can handle the investment for out of state investors by offering top to bottom property management, construction & investment services.